As the spring semester heads toward the finish line, setting up a stock exchange could be a fun and productive way to spend some of the extra time you will have over summer break.

And if you are new to the process, don’t worry. I’ll walk you through it.

But, first, here is some information about stocks and how the stock market works.

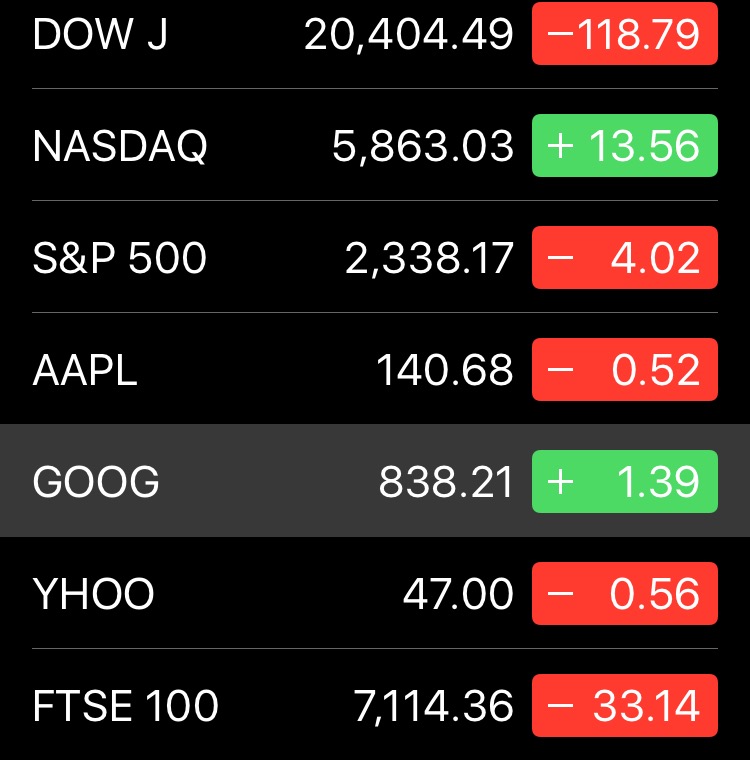

- You typically buy common stock, which is basically ownership in the company you are buying stocks in. Stocks have symbols, such as AAPL for Apple or AMZN for Amazon. You really want to own around 20 to 25 stocks for proper diversification. You do not want to buy all of your stocks in one company.

- Stocks trade at the real time while the markets are open, which means they constantly fluctuate based on supply and demand. You can place orders of stocks before the market opens or after the market closes, but your trade will not execute until market opens.

- Orders are placed on exchanges like the New York Stock Exchange or NASDAQ. If you own stock you are considered a shareholder.

Setting up a stock exchange may seem difficult, so here is a step-by-step process to help you get ready to buy your first stock.

Step 1

You will want to open an investment account at a financial institution. (This would include Merrill Lynch, Charles Schwab, Edward Jones, etc.) The account has to be able to let you buy stocks (securities). When opening your account you will need to provide personal info such as your address, social security number, date of birth, employment info, income and net worth as well as how much you have in investable assets. You will also need to provide what investment experience you have and what types of stocks you have experience buying in.

Step 2

You will need to deposit funds into your account. You can deposit checks, wire funds or even electronically transfer funds. You cannot deposit cash due to money laundering laws.

Step 3

Place your order through your advisor. You will need to confirm the number of shares you want and if you want to buy at market price or at a set price you come up with.

Step 4

When the order is executed, your advisor will confirm the number of shares you bought and the execution price.

Step 5

Experience the joy of stocks and trading stocks.

This information comes from Chadwick D. Carlson, a financial advisor for Merrill Lynch Wealth Management.